Find Cheap Car Insurance in Pittsburgh, PA

Learn More about Auto Insurance in Pittsburgh, Pennsylvania

Pittsburgh has a rich history in the steel industry, earning its “Steel City” moniker. The city played a significant role in steel production, which heavily influenced its industrial growth in the 19th and 20th centuries.

In addition to its industrial past, Pittsburgh is home to renowned museums such as the Andy Warhol Museum and the Carnegie Museum of Natural History, offering diverse cultural experiences for visitors and locals.

If you’re driving in Pennsylvania, remember that auto insurance is a legal requirement. Consider Acceptance Insurance for cheap car insurance tailored to your needs, regardless of your driving record. Discover all you need to know about vehicle protection in the region and explore the best discounts available for you.

How Much Does Car Insurance Cost in Pittsburgh, Pennsylvania?

In Pittsburgh, residents can obtain basic liability car insurance for roughly $30 per month. This rate is considerably lower than the national average of $52 and is $15 cheaper than the Pennsylvania state average of $45.

If you’re considering upgrading to full auto insurance, the monthly cost is approximately $117. This is significantly $89 less than the Pennsylvania average, which is currently $206, and $51 below the national average of $168.

Reasons Why Insurance is so Cheap in Pennsylvania

There are several reasons why car insurance in Pennsylvania tends to be more affordable. One contributing factor is the healthy level of competition among carriers, which can lead to better prices for consumers. Another reason is the lower population density in Pennsylvania compared to other states like California or Texas, resulting in fewer accidents and insurance claims, ultimately leading to lower premiums.

Additionally, the Keystone State has fewer uninsured drivers, which helps reduce risks for other drivers and carriers.

Ready to Get a Quick Quote?

Compare Car Insurance Rates by City in Pennsylvania

Vehicle protection prices can differ greatly from one city to another, even within the same state. Various factors like traffic volume, crime rates, weather conditions, and the frequency of insurance claims in each area all play a role in these disparities. Don’t forget to check out the table below to see how the average pricing compares in different cities across the Keystone State.

Compare Car Insurance Rates by Zip Code in Pittsburgh

Your coverage rates aren’t just influenced by where you live, but your specific zip code can also have a significant impact. Some neighborhoods may pose greater risks for drivers, whether due to more accidents or other factors, such as Penn Avenue or Carson Street. Providers take all of this into consideration. Review the table below with the average premiums for various Pittsburgh zip codes.

Low-Cost Car Insurance Rates by Age in Pittsburgh

Do you have someone in your household who’s under 25, or maybe a teenager getting ready to hit the road? Getting insurance for teenagers can pack a punch on your wallet. Providers usually charge more for young drivers because they’re seen as riskier. Take a look at the chart below to see how monthly average costs compare across various age groups in Pittsburgh.

*To calculate average costs, we utilize the following method: a 30-year-old male, with state minimum liability and full coverage of 100/300/100.

Typical Driving Conditions in Pittsburgh

How Many Accidents Happen Per Year in Pittsburgh, Pennsylvania?

Pittsburgh is part of Allegheny County, which holds the unfortunate title of having the highest number of car crashes in Pennsylvania.

According to data from the Pennsylvania Department of Transportation, there were a staggering 10,348 crashes in Allegheny in 2023, resulting in 4,163 crashes with injuries and 75 cases with fatalities. It’s crucial to know that all car accidents impact insurance premiums, and the repercussions can be severe, including property damage, injuries, and the potential for higher costs associated with obtaining high-risk coverage.

Are Road Infrastructure and Bridges in Pittsburgh Well Maintained?

The majority of Pittsburgh’s streets and infrastructure are well-maintained, thanks to ongoing efforts by the city and county.

In 2025, the extensive rehabilitation of the historic Armstrong Tunnel will be completed, with an investment exceeding 13 million dollars. Moreover, the maintenance project for the Glenwood Bridge is poised to include repaving and expansion. These are just a few examples of the myriad improvement projects underway, totaling a notable investment of 441 million dollars.

As we look to the future, there are further enhancements in store. By 2026, a series of upgrades will be finalized on the I-376 Parkway East – Churchill to Monroeville. This $70.1 million project will encompass a superstructure replacement over Old William Penn Highway, two bridge rehabilitations over Old William Penn Highway, and preservation efforts for six bridges along the I-376.

Minimum Car Insurance Requirements in Pittsburgh

Pennsylvania’s car insurance laws ensure that drivers maintain continuous coverage, which is closely monitored by carriers through a real-time database. Operating under a no-fault system, the state mandates drivers to provide proof of coverage when registering a vehicle. Mandatory vehicle protection in the Keystone State includes:

- $5,000 for Personal Injury Protection (PIP)

- $15,000 per person / $30,000 total for Bodily Injury in an accident

- $5,000 for Property Damage Liability

What Are the Penalties for Driving Without Auto Insurance in Pittsburgh, Pennsylvania?

Driving without insurance in Pennsylvania can land you in hot water. For a first offense, you could face a minimum fine of $300, a three-month suspension of your driver’s license and vehicle registration, and the possibility of having your car impounded. Resolving this situation comes with costs, including a $94 restoration fee (or $202 for commercial drivers) to reinstate both your license and registration. Moreover, repeated offenses can lead to increased penalties.

Note: Even a brief lapse in your policy can lead to fines, as the state has real-time access to insurance database information, which verifies continuous coverage.

Factors Considered for Determining Car Insurance Rates in Pittsburgh

Grasping the factors that shape your auto insurance rates is essential for obtaining the ideal coverage you want. Numerous elements play a role in determining your monthly costs. Here’s a breakdown of the key elements to keep in mind:

- Vehicle type

- Driving record

- Level of coverage

- Deductible amount

- Marital status

- Any previous insurance claims

Here’s What You Need to Know When Driving in Pennsylvania

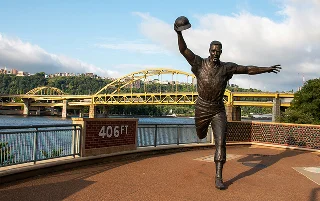

Driving in Pennsylvania can present its own set of challenges, with diverse landscapes ranging from bustling cities to serene countryside. The state is renowned for its rolling hills, valleys, and charming small towns. However, navigating through urban areas like Pittsburgh can be particularly daunting. This city, known for its three rivers and numerous bridges and tunnels, poses unique obstacles to drivers. Streets like Carson Street are notorious for their danger, attributed to a mix of aggressive drivers and heavy traffic congestion.

Furthermore, ongoing construction projects often lead to partial or complete closures on various roads across the city. It’s important to stay informed and plan your routes accordingly. Being cautious and avoiding distractions can help navigate Pittsburgh’s evolving traffic conditions.

Top Ways to Save on Car Insurance in Pittsburgh, PA

Trying to cut down your insurance premiums on your Pittsburgh policy? Well, you can improve your monthly budget by taking advantage of various auto insurance discounts.

Here are a few you could score:

Plus, if you bundle your policies, like your auto plan with renters insurance, you could potentially slash your total bill by 15%. Speak with your local agent to start saving!

Obtain Your Car Insurance Quote in Pittsburgh Today!

Don’t miss out on potential savings – get the peace of mind you deserve with cheap car insurance from Acceptance. Call 877-405-7102, visit our nearby office, or get a free insurance quote online. Switch to us for top-notch protection on your journey!

Get Started