Cheap Car Insurance in Texas

Everything You Need to Know About Auto Insurance in Texas

Texas can be a state of extremes: From extreme weather to extreme rodeo sports, Texans are proud of the Lone Star State. There’s plenty here for all to explore and enjoy, starting with bountiful fields of bluebonnets in the spring and ending with some world-famous barbecue anytime of the year. From Dallas and Fort Worth in the north to Galveston, Corpus Christi and Padre Island in the south, residents and visitors alike will never run out of things to do.

History buffs will love to explore the iconic Alamo in San Antonio or the Star of the Republic Museum in Washington, TX. For those that love the outdoors, there is a plethora of opportunities all over the state. Camp at Big Bend National Park and raft the Colorado River. Mexico is visible on the other side. Lost Maples State Natural Area in the Hill Country offers a fall leaves display that almost rivals the east coast. Visit the Gulf of Mexico across the southern part, with sandy beaches and plenty of shrimp.

Austin, Houston and Dallas offer a wide variety of cultural festivals and events, celebrating the range of ethnic backgrounds that make up Texas. Traveling in the Lone Star State can be daunting, since there are 800 miles from north to south. Don’t forget to get affordable car insurance before you hit the road: it’s the law!

How Much Does Car Insurance in Texas Cost?

Texas car insurance rates are very close to the national average. For example, Texas drivers pay, on average, $2,019 for full coverage car insurance annually. Nationally, the average for full coverage is $2,014.

For the average cost of basic required liability insurance, Texans pay $565 annually, while nationwide, the average is $622.

Drivers in the Lone Star State pay more than drivers in many states. This can be attributed to the state being home to three of the largest cities in the nation. More people means more congestion, resulting in an increased number of accidents. AS with other places, car repair costs and medical bills continue to rise, making it more expensive for everyone involved in an accident.

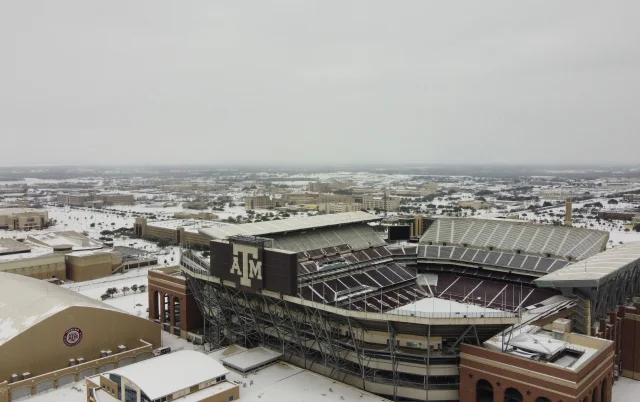

Climate change has increased the number of severe weather events in the Lone Star State, as well, meaning insurers are stepping up more often and pay for damages resulting from storms, tornadoes and hurricanes.

At Acceptance, our friendly agents can help their fellow Texans find the perfect policy that fits their needs and their budget.

Ready to Get a Quick Quote?

What Is the Average Premium for Cheap Full Coverage Car Insurance in TX?

Full coverage in Texas comes in at $168 monthly on average. Full coverage consists of the required liability, but adds first-party benefits such as collision and comprehensive. Texas is an at-fault state, which means if you cause a wreck, your insurance will pay for the injuries and damages you cause, up to your policy limits. However, liability does not kick in anything toward your own repairs. That’s where collision and comprehensive come in: Whether your vehicle is damaged in a wreck you caused or from something else, such as a hailstorm, this package will pay for the repairs or replacement.

Full coverage is your best option to repair or replace a vehicle, no matter the age and value. There is a deductible with both collision and comprehensive and you can purchase either one separately if you wish.

How Much Does Liability Insurance or Minimum Required Auto Coverage Cost in TX?

Texas drivers pay $47 monthly, on average, for the basic required liability coverage. This only covers you up to your policy limits for bodily injury/death liability and property damage liability you cause others when you are at fault in an accident.

For example, if you hydroplane on a wet afternoon and slam into someone’s brand new car, your basic liability limits for damage to their vehicle is $25,000. If someone is hurt, your basic liability will pay for up to $25,000 in medical bills, lost wages and other expenses.

With today’s repair costs and medical bills, those amounts may be used up quickly, leaving you to pay the rest out of pocket. And with only basic liability, you’ll be paying for all your own damages out of pocket. This is one reason many drivers increase their limits to 100/300/100.

If you cannot come up with the money after your policy has paid, you may be sued and your assets can be seized. Liability insurance is a cheaper car insurance option, but it comes with risks.

How do Insurance Rates Compare Across Texas’ Major Cities

Where you live is a major factor insurer’s use to determine your rates. Those who drive in congested cities may face a higher premium than those who drive on rural roads. Is vehicle crime high in your area? That can impact your rates, as well. Here are some Texas cities to compare:

We use the following methodology to arrive at our average cost: male, age 30, state minimum liability and full coverage of 100/300/100.

What are Some Car Insurance Discounts in the Lone Star State?

Most insurers offer discounts to their customers. Almost everyone qualifies for some discount, so just ask your friendly neighborhood agent for his or her recommendations. For example, if you are free from accidents, tickets or claims in the last three years, you may qualify for one of the best discounts out there: the safe driver discount.

Another high discount is bundling. Those who bundle their auto and home insurance may receive up to 25% off their combined policy premiums. Other discounts include:

Ask your independent neighborhood agent for more information on what discounts are available.

Types of Auto Insurance Coverage

Texas Car Insurance Laws

Texas is an at-fault state. The state-required coverage is to help pay for injuries and damages you cause. Insurers report new policies and lapsed and cancelled policies in real time, so if you get stopped or have an accident, the chances are good the responding police will know if you do not have coverage.

What are Mandatory Vehicle Insurance Requirements in Texas?

Mandatory car insurance requirements in Texas include:

- Bodily Injury Coverage per Person: $30,000

- Bodily Injury Coverage per Accident: $60,000

- Property Damage Per Accident: $25,000

In Texas, drivers are required to refuse uninsured motorist coverage (UM) in writing. Since there are plenty of people driving in Texas without insurance, you should consider adding UM to your policy.

Check with your friendly local Acceptance agent to make sure you have the right amount of coverage.

What Happens if You are Caught Driving Without Insurance in TX?

Other than DUI, driving without insurance is one of the reasons why SR-22 insurance is needed in the Lone Star State. Those who drive without insurance are subject to fines (up to $350 for a first offense), plus court costs. The possibility of losing your license and registration is present for multiple offenses.

What Factors Does Texas Law Allow in Determining Your Insurance Premiums?

The average amount Texans in various cities pay is calculated by a long list of factors insurance underwriters plug into an algorithm. Algorithms may be slightly different between carriers and much of your information is specific to you. Therefore, premiums for different drivers will be higher or lower than the average.

Unique factors include age, gender and driving record, while others, such as zip code, apply also to your neighbors.

Some common factors Texas insurers look at include:

- Age, gender

- Driving record and claims history

- Credit score

- Type of vehicle

If your driving record or credit score is less than perfect, you can work to improve these metrics and see your premiums go down as a result. Likewise, young drivers will see their policy costs drop, as well, as they age and if they keep a clean record.

Am I Required to Report an Accident in Texas to Authorities?

Only under certain circumstances, including if there is an injury or death, the vehicles cannot be moved or property damage exceeds $1,000. If these conditions are not met, you do not have to report an accident. However, keep in mind that a police report might be the only thing between you and another driver who disputes the facts.

Find an Office Near You

What is Driving in Texas Like?

In major cities, congestion causes issues for drivers on the roads. Outside of those cities, you can drive for miles and never see another vehicle. There are many two-lane roads (even highways) in Texas.

As far as weather is concerned, the southern part of Texas is humid and can be rainy. There’s a danger of hurricanes at some times. In the more northern areas, tornadoes and ice storms can cause hazardous conditions.

How Many Car Accidents Happen in TX?

In 2021, 4,497 people were killed in 4,068 fatal accidents in Texas. This was an increase of 15.43% over the 3,896 deaths in 2020. Rural areas accounted for slightly more than half of fatal car crashes, with 611 people dying in head-on collisions. Motorcyclists (and their passengers) who died on Texas roads counted 522, with 45% of those not wearing a helmet.

Drivers under the influence of alcohol accounted for the deaths of 1,141 people. The majority happened on Sunday mornings between 2 a.m. and 2:59 a.m.

How Many Drivers are Uninsured/Underinsured Motorists in TX?

An estimated 20% of all Texas drivers are on the road without insurance. That is one in five drivers in the Lone Star State. Choosing to carry uninsured motorist coverage or underinsured motorist coverage can offer financial protection if you are in an accident caused by one of these drivers or a hit-and-run.

FAQs About Texas Car Insurance

I am a Low-Income Driver. How Can I Find the Cheapest Car Insurance in Texas?

Here are 4 ways to decrease the cost of your car insurance in Texas:

- Lower policy limits: The higher your limits the more you’ll pay. Keep in mind that lower limits leaves you open to out-of-pocket expenses in an at-fault collision. Raise your policy limits back up as soon as you can.

- Increase policy deductible: Most people choose a $500 or $1,000 deductible. The higher it is, the lower your premium. Remember you will need to come up with this amount if you cause an accident.

- Ask about discounts: Even one discount can help. Bundling policies will get you the greatest discount.

- Drive a safe and reliable vehicle: Cars known for being reliable and safe cost less to insure.

Can an Undocumented Worker Get Auto Coverage in Texas?

For the most part, the answer is no. Most insurance companies would prefer you to have a driver’s license before issuing a policy. However, you may be able to find one by shopping around that will work with you.

Is It Possible to Get Car Insurance in Texas with a DUI on my Record?

Yes. Your insurance rates will probably increase with a DUI on your record, but you can shop around and find affordable DUI insurance with the right company. Check out the knowledgeable agents at your local Acceptance office. They can help you compare rates from various carriers to find the best one.

Find Affordable Car Insurance in Texas Today!

Our local agents at Acceptance Insurance understand Texas car insurance laws and requirements. Our welcoming team will help you find a customized, flexible policy that meets your needs – and your budget. Give us a call at 877-405-7102, check us out online for a quick quote or stop by one of our local Texas offices.

Get Started